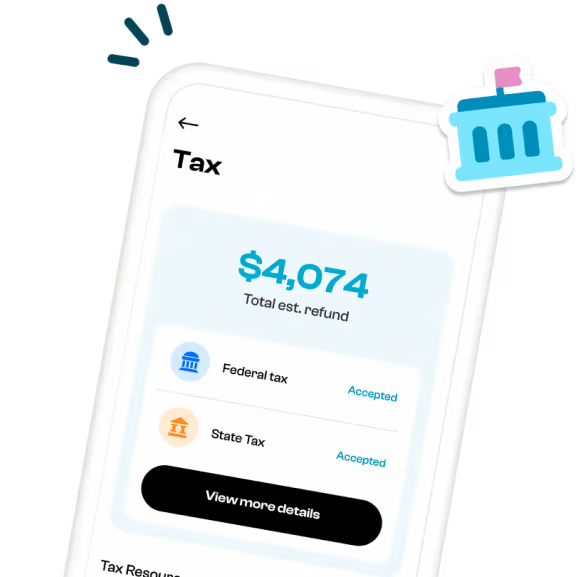

File Taxes Online with Marygold & Co. For Free Today!

Own Your Tax Return

Marygold & Co. is a secure all-in-one banking and payment services app offering FREE FDIC-insured accounts*** with a Debit Mastercard®. Own your finances with Marygold & Co, a secure way to send, receive, spend, save and invest with no banking fees or minimum balance requirements. We’ve partnered with april to offer NO-FEE* tax filing to our clients in 2024 to help you own your tax return.

Filing Taxes Your Way with Marygold & Co.

Powered by april is Fast, No-Fees*, and Flexible.

Powered by april is Fast, No-Fees*, and Flexible.

Got tax questions?

April’s team of tax experts are here to support you.

Contact them during extended hours (9am-8pm, EST 7 Days a Week) during tax season.

We’re Here to Help!

April support:

Email at support@getapril.com for all general support inquiries

april's live chat is available in the app or on help.getapril.com

For customers utilizing our assist service, email: assistsupport@getapril.com

April’s Hours of Operation:

Support (Tax Season):

Sunday - Sunday 9:00 am - 8:00 pm EST (January-April)

Support (Off Tax Season):

Monday - Friday 9:00 am - 6:00 pm EST (May-December)

Marygold & Co. support:

Call us at 877-249-8973

Email us at support@marygoldandco.com

Marygold & Co.’s Hours of Operation:

Monday - Saturday 6:00 am - 10:00 pm EST

Legal

Resources

*Filing taxes with Marygold & Co. is fee free for 2024 tax season only

**If you find an error in the tax preparation that entitles you to a larger refund (or smaller liability), april will refund any fees you paid us to use our service to prepare that return and you may use our service to amend your return at no additional charge. To qualify, the larger refund or smaller tax liability must not be due to differences or inaccuracies in data supplied by you, your choice not to claim a deduction or credit, positions taken on your return that are contrary to law, or changes in federal or state tax laws. If our tax preparation software makes a mathematical error that results in your payment of a penalty and/or interest to the IRS that you would otherwise not have been required to pay, April will reimburse you up to a maximum of $10,000. If you receive an audit letter from the IRS or a state tax authority in connection with an accepted tax return filed through April, aprilwill provide you with informational assistance, such as responses to frequently asked questions or links to resources on the IRS’s or other tax authority’s website. April will not represent you before the relevant tax authority or provide legal advice.***Money Pool accounts are not FDIC-insured

Marygold & Co. is a financial technology company and not a bank. Deposits insured by the FDIC, up to the allowable limit by our issuing and deposit bank partner(s).

Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.